Introduction

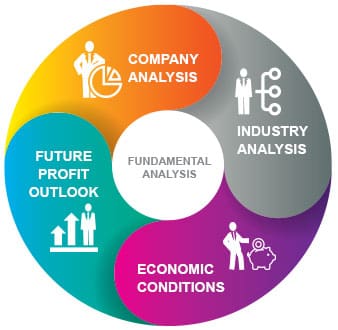

Fundamental analysis is a mechanism which is used to determine a stocks actual or """"fair market"""" value. Fundamental analysts look for a stock which is currently trading at a price that is either higher or lower when compared to its real value. In simple words, fundamental analysis is examining a business, its history, the economy, and the market in order to put together an investment decision concerning a particular stock.